London, February 15, 2026, 13:53 GMT — Market closed.

- Diageo shares closed Friday down 1.35% at 1,824 pence.

- A regulatory filing flagged a temporary external executive role for senior director Susan Kilsby.

- Focus now turns to Diageo’s February 25 interim results and the dividend timetable that follows.

Diageo shares (DGE.L) ended Friday at 1,824 pence, down 1.35% on the day, after trading between 1,807 and 1,841 pence. About 4.0 million shares changed hands, according to market data. (Investing)

With London shut for the weekend, the next hard catalyst is Diageo’s interim results. The company said it will publish fiscal 2026 interim results on Feb. 25, with a webcast at 0705 GMT and a live Q&A call at 0930 GMT led by CEO Dave Lewis and CFO Nik Jhangiani. (Diageo)

The timing matters. Britain’s FTSE 100 has been hovering near recent highs, supported by takeover activity and expectations for Bank of England easing, even as officials warn inflation is still not beaten. (Reuters)

Diageo also made a small governance disclosure late Friday. It said senior independent director Susan Kilsby will be appointed executive chair of Fortune Brands Innovations from Feb. 12 to May 13, taking on chief executive duties during that period, before returning to her non-executive chair role at the U.S. group. (Investegate)

Dividend timing is another date-setter on traders’ screens. Diageo’s financial calendar lists April 16 as the UK ex-dividend date for the interim dividend, pending board approval, with the record date on April 17 and payment set for June 4. Ex-dividend is the point when a stock starts trading without the right to the upcoming payout. (Diageo)

Diageo is a UK-based maker and distributor of premium spirits and beer, with brands including Johnnie Walker, Smirnoff, Guinness and Tanqueray, according to LSEG data carried by Reuters. (Reuters)

Policy headlines still jerk the sector around. In January, European spirits groups including Diageo, Pernod Ricard and Rémy Cointreau fell after President Donald Trump flagged plans for new U.S. tariffs on some UK and EU imports, raising fresh questions over pricing and demand. (Investing)

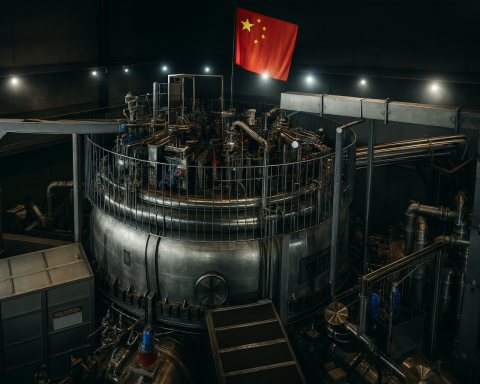

Some trade news has pointed the other way. China said it would reduce tariffs on Scotch whisky to 5% from 10% after talks between leaders, which Britain’s government framed as a boost for UK whisky exporters over time. (Reuters)

Street positioning is not one-way. Recent broker calls logged on LSE.co.uk show RBC Capital Markets at “Outperform” with a 2,000p target, while JP Morgan Cazenove has “Neutral”; Jefferies has kept “Buy” but cut its target to 2,000p earlier in January. (London South East)

But the path into results is not clean. In November, Reuters reported net debt at about 3.4 times EBITDA — a cash-earnings yardstick — and flagged investor debate over whether Diageo might lean harder on asset sales or dividends as it works to reduce leverage; Goodbody analyst Fintan Ryan said “it’s probably not the best time to be actively flogging assets.” (Reuters)

Diageo has also set expectations cautiously. The company said in November it expected fiscal 2026 sales to be flat or slightly lower, with only low- to mid-single-digit operating profit growth. (Reuters)

For the week ahead, the market’s main checkpoint is Feb. 25, when Diageo is scheduled to report interim results for the six months ended Dec. 31, 2025. That is likely to set the tone for how investors price demand, margins and shareholder returns into the spring. (Diageo)