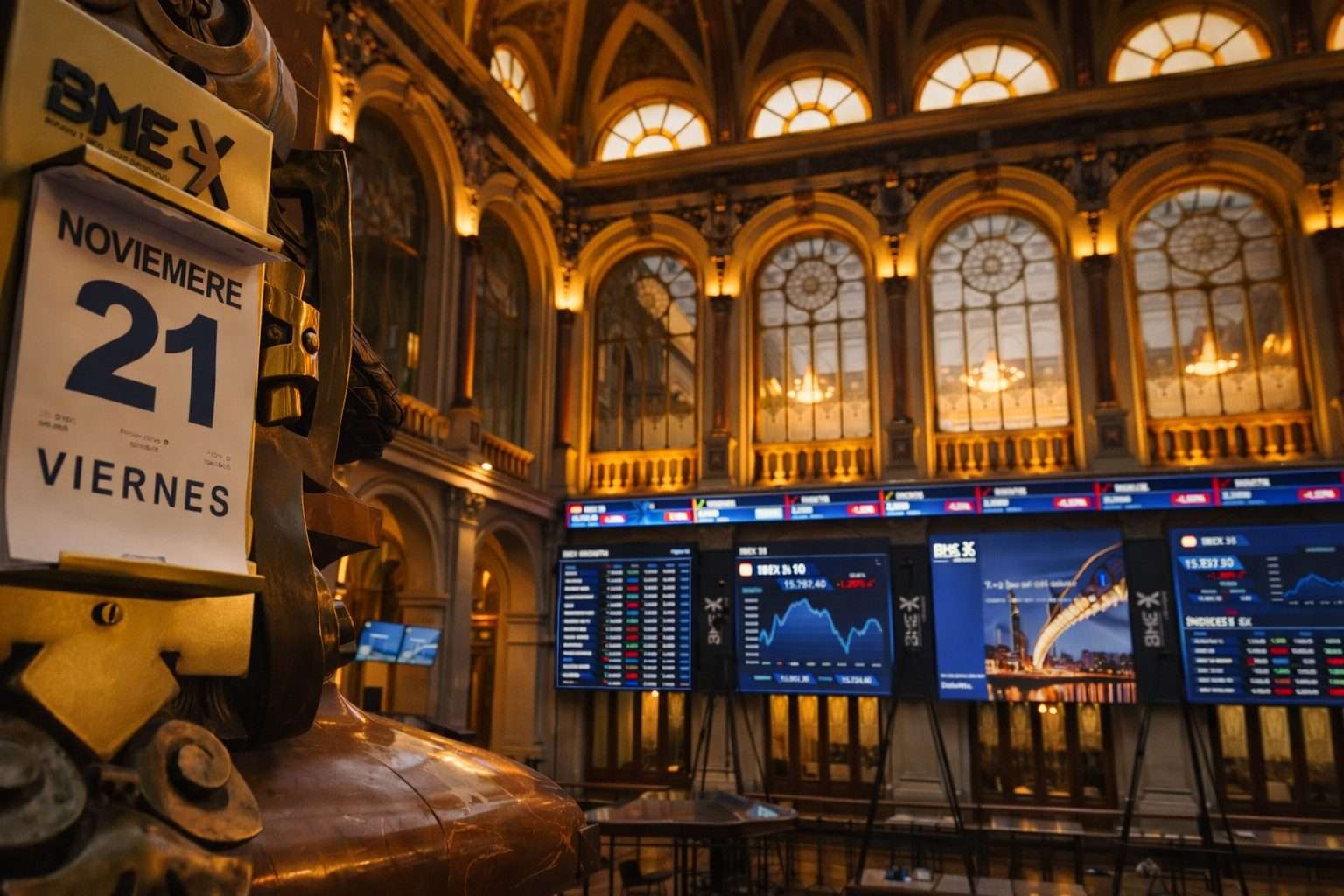

Madrid, Feb 22, 2026, 08:45 CET — Market closed.

- Spain’s IBEX 35 last closed at 18,186 points, ending its strongest week since November.

- Endesa and Iberdrola headline a busy utility-heavy stretch of results and strategy updates.

- Spain’s flash inflation print and a packed ECB calendar could reset rate bets.

Spain’s IBEX 35 heads into Monday after finishing Friday up 0.94% at 18,186 points, according to MEFF data. The benchmark rose 2.9% over the week, its best since November, Spanish financial daily Cinco Días reported. (Meff)

That run matters because the next leg is likely to come from a narrow set of drivers: utilities guidance, inflation and the rate outlook. Madrid is heavy in power names and banks, and both react fast when bond yields move.

A U.S. Supreme Court ruling that struck down President Donald Trump’s sweeping tariffs helped lift risk appetite into the weekend, pushing Europe’s STOXX 600 to a record close, Reuters reported. IG chief markets strategist Chris Beauchamp called the decision a mixed blessing, saying “it will increase this legendary uncertainty” and warning the U.S. president could try other routes to reimpose levies. Banks were among the week’s strongest sectors in Europe, while energy stocks slipped on Friday as oil hovered near six-month highs, the report said. (Reuters)

In Madrid, Repsol adds its own wrinkle. The company cut its 2030 renewable capacity target to just over 10 gigawatts from a 20 GW plan set out in 2021, and said higher development and financing costs and U.S. tax incentives were reshaping where it puts money; CEO Josu Jon Imaz said it would “modulate medium-term goals” while keeping longer-term objectives. Repsol shares ended Friday at 18.30 euros, up 0.88%, according to Investing.com data. (Reuters)

Endesa is first up among the big utilities. The company said it will present its 2025 results and an updated 2026–2028 strategic plan on Feb. 24 at 09:30 CET. (Endesa)

Iberdrola follows a day later. The company is due to present its 2025 results on Wednesday, Feb. 25 at 09:30 in Madrid, according to a notice on its website. (Iberdrola)

Aena also has a date in the diary. In a notice filed in Madrid, the airport operator said it will hold a conference call to present full-year 2025 results on Feb. 25 at 1:00 p.m. local time. (Aena)

Macro is the other hinge. Spain’s statistics institute INE has scheduled its “advance” consumer price index — a preliminary inflation estimate — for Feb. 27, its calendar shows. (Instituto Nacional de Estadística)

The ECB sits in the background, and not always quietly. ECB President Christine Lagarde has tried to cool talk of an early exit, telling the Wall Street Journal that her “baseline is that it will take until the end of my term” in October 2027; Oxford Economics said the episode underlined that central bank leadership is “a matter for high politics.” Lagarde is also listed to speak at the Brussels Economic Forum on Feb. 23 at 18:30 CET, according to the ECB’s schedule. (Reuters)

But the week has an obvious downside scenario: tariff uncertainty reasserts itself, inflation surprises higher and rate-sensitive utilities lose their bid. A sharp swing in oil, already near recent highs, would also cut both ways for an index that mixes energy exposure with tourism and transport names.