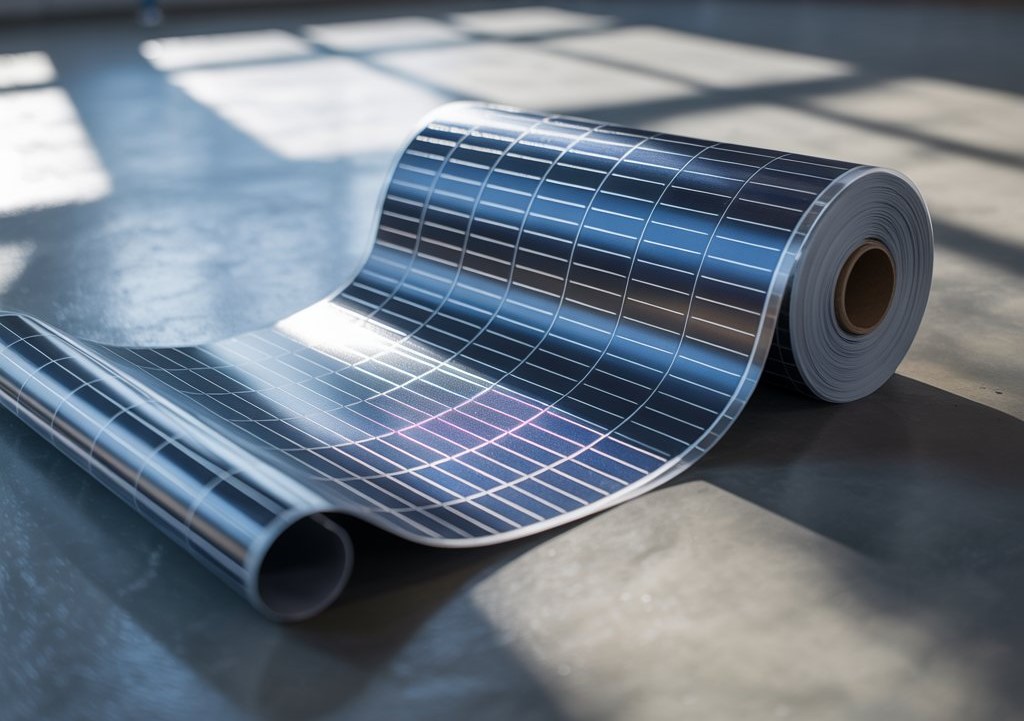

Les « autocollants » solaires en pérovskite arrivent bientôt : comment des laminés flexibles pourraient transformer murs, voitures et toits en centrales électriques

Un module pérovskite flexible avec WVTR ≈ 5,0 × 10⁻³ g/m²/jour a conservé 84 % de sa puissance après 2 000 heures à 85°C/85 % HR (Damp-Heat). Le Japon subventionne Sekisui Chemical pour construire une usine de pérovskite de type film de