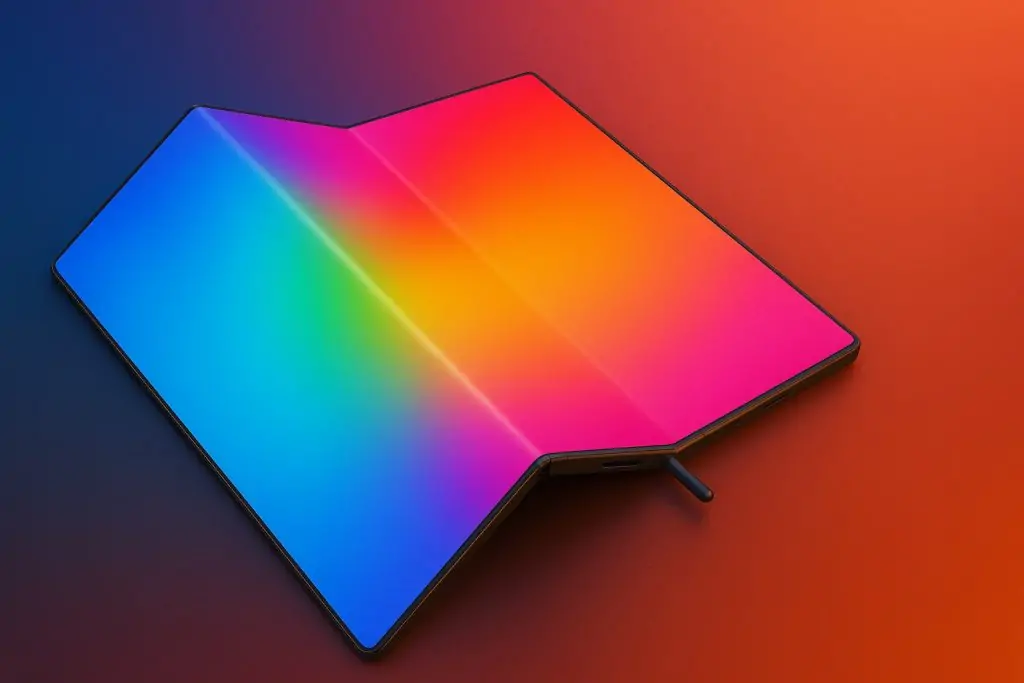

삼성 갤럭시 트라이폴드 폰 유출: 3개의 배터리, 10인치 디스플레이, 글로벌 출시 암시

Tri-Fold 콘셉트 티징 삼성은 2024년 초부터 트라이폴드(삼중 접이식) 폰을 암시해 왔습니다. 갤럭시 S25 언팩 행사(2025년 1월)에서 로드맵 슬라이드에 잠깐 “트라이폴딩 폰” 아이콘이 등장했습니다 techradar.com. 삼성디스플레이는 CES 2025에서 트라이폴드 패널 프로토타입도 선보이며 더블 폴드(“Z-폴드”) 스크린을 시연했습니다. 프로토타입을 직접 본 TechRadar 에디터들은 넓어진 화면