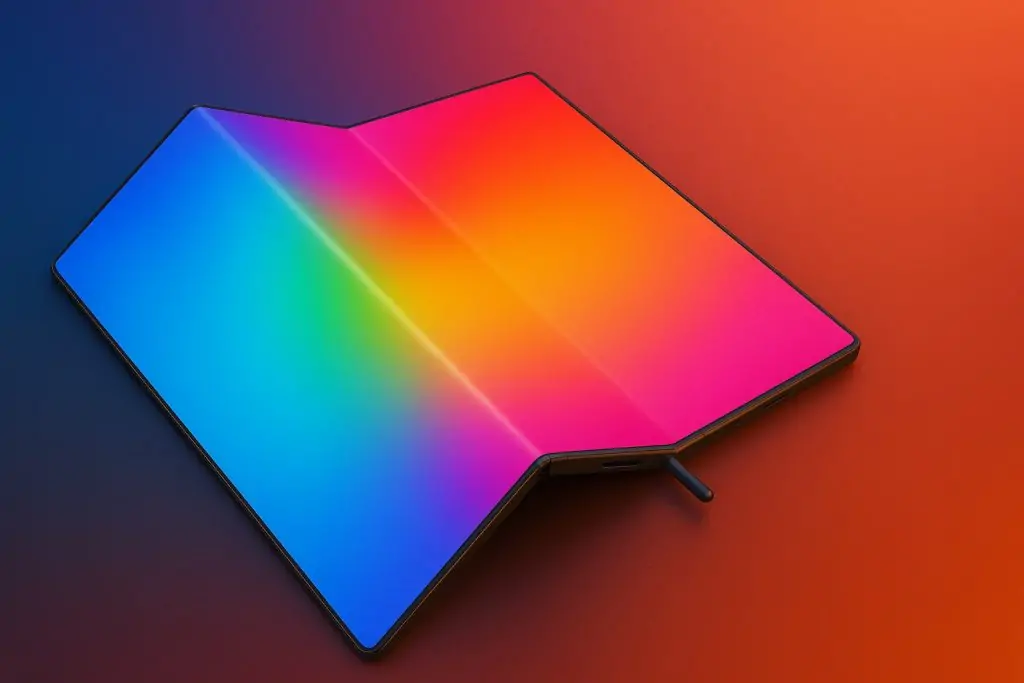

Procurio Samsung Galaxy Tri-Fold telefon: 3 baterije, 10-inčni ekran i globalno lansiranje na pomolu

Najava Tri-Fold koncepta Samsung nagoveštava telefon sa tri preklopa još od početka 2024. Na Galaxy S25 Unpacked događaju (januar 2025), na jednom slajdu sa planom razvoja nakratko se pojavio ikonica “trifolding phone” techradar.com. Samsung Display je čak prikazao prototipove panela sa tri