SAN FRANCISCO, Jan 16, 2026, 09:28 (PST)

- Nvidia reports that memory supply bottlenecks are restricting GeForce RTX GPU production

- On Friday, major retailers saw RTX 5070 listings switch rapidly between available and sold out.

- GPU manufacturers are deciding which models to produce as limited supplies of GDDR7 memory force rationing

Nvidia revealed on Friday that “memory supply” issues are restricting the output of its GeForce RTX graphics cards, a bottleneck that has made the RTX 5070 especially scarce in consistent quantities. 1

Positioned squarely in Nvidia’s desktop lineup, the RTX 5070 targets gamers looking to upgrade older rigs. This segment often feels the pinch quickly when supply tightens, as buyers scan for competitive prices and bail when markups climb too high.

Memory chips—the ones that store data for graphics processing—are creating a bottleneck right now, especially as AI data centers soak up more capacity. “We have to support memory consumption for AI infrastructure,” Sungsoo Ryu, CEO of SK Hynix America, told Reuters. SK Hynix is one of Nvidia’s key suppliers. 2

Board partners have been trying to ease concerns following conflicting supply reports. Asus, one of Nvidia’s largest add-in-board partners—the companies that create custom versions of Nvidia’s GPUs—clarified it has no intention of halting sales of its RTX 5070 Ti and RTX 5060 Ti 16 GB models. The company attributed the rumors about those cards being discontinued to “incomplete information.” 3

Gigabyte CEO Eddie Lin highlighted a tough reality: the GDDR7 memory shortage means companies might prioritize allocating this limited resource to products that generate higher revenue per gigabyte. “They will calculate how much revenue … per gigabyte of memory,” Lin explained in an interview featured on Tom’s Hardware. 4

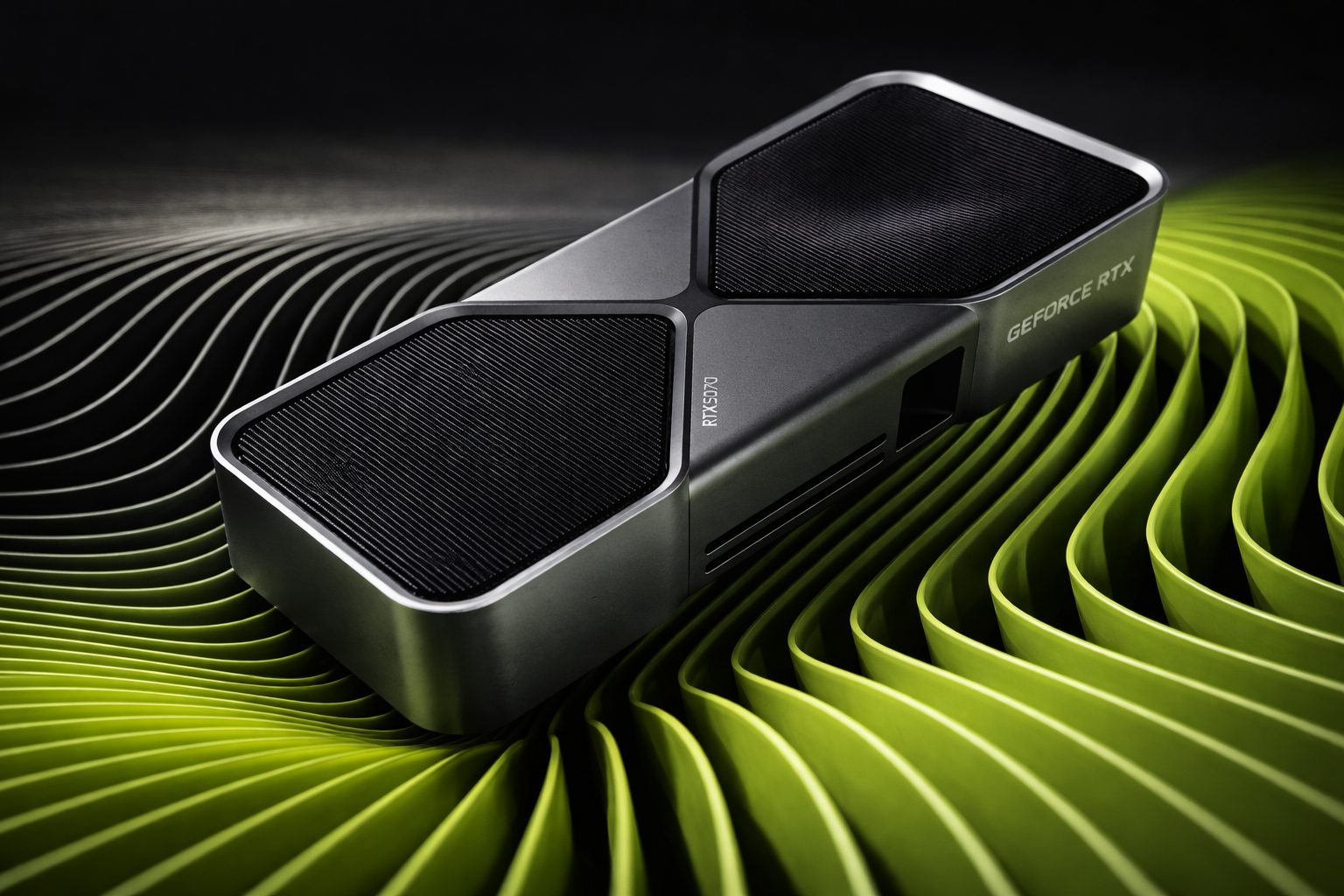

Nvidia’s specs for the RTX 5070 show it packed with 12 GB of GDDR7 memory running on a 192-bit bus, drawing up to 250 watts of graphics power. The company recommends a 650-watt power supply for the system and positions this card just below the higher-end RTX 5070 Ti. 5

The RTX 5070 hit the market with a $549 MSRP, but Nvidia held back its Founders Edition, letting partner cards take the spotlight first. This move nudged initial buyers toward third-party options. Early reviews questioned Nvidia’s comparisons to the much pricier RTX 4090 flagship. 6

On Friday, a NowInStock tracker spotted several RTX 5070 models briefly appearing at Amazon, B&H, and Newegg. Prices ranged from $549.99 to as high as $639.99. The listings repeatedly switched back to “out of stock” for various models. 7

Competition is heating up in the same price range. In the U.K., PC Gamer’s price watch showed the RTX 5070 going for around £480 on Amazon. AMD’s Radeon RX 9070 came in about £30 higher but generally delivered better performance — including in ray tracing, the gaming lighting technique — though prices have started creeping back up. 8

That balance might shift fast if the memory shortage worsens. Should suppliers continue focusing on data-center components, Nvidia and its partners could push more models with lower memory demands or better profit margins. This would likely result in uneven RTX 5070 availability and street prices climbing above MSRP.

The real test will be if retailers can hold cards in stock for days instead of just minutes, and if partner models start selling near list price rather than hundreds of dollars over. Right now, buyers are focused on restocks more than fresh releases.

Nvidia hasn’t indicated when the supply issues might improve, nor has it shared any shipment targets for the RTX 5070 series. The coming weeks will reveal if Friday’s brief availability was a sign of steady restocks or just a short-lived opportunity.